Lease extensions are commonly sought by flat owners and leaseholders wanting to add value to their property or to make it more saleable. But the lease extensions process can be complex, and one of the concerns that often arise with **lease extension legal fees** is the matter of legal costs and fees. Let’s dive into understanding **lease extension legal costs and fees**, why they are necessary, and how they can impact your decision to extend your lease.

What is a Lease Extension?

In a leasehold property arrangement, you own the property but not the land it stands on. This land is owned by the freeholder or landlord extending your lease. Over time, as your lease drops or the length of the lease decreases, the value of the property can diminish, and it can become harder to secure a mortgage. Extending the to extend your lease or extending to extend your lease, can mitigate these issues.

Why Are Legal Fees Involved?

The process of extending a full leasehold reform involves legal work to ensure that both the cost of a lease-holder and the freeholder or landlord’s rights to lease, are protected. This includes:

- Valuation: Determining the correct price to pay for the extension.

- Negotiations: There might be back-and-forth discussions between the leaseholder and the freeholder about the terms of the extension.

- Drafting the Deed of Variation: This is the legal document that confirms the changes to the original lease.

- Land Registry Updates: Once the extension is agreed upon, the updated lease needs to be registered with the Land Registry.

Each of these stages of expensive process requires the expertise of legal professionals who understand property law.

Typical Lease Extension Legal Fees:

- Solicitor’s Fees: Your solicitor will handle most of the legal work. Their fees can vary widely based on their location, expertise, and the complexity of your lease. Generally, you can expect to pay anywhere from £1,000 to £2,500 or more.

- Valuation Fees: Hiring a chartered surveyor to determine the correct premium for the lease extension can cost from £500 to £1,500, depending on the property’s location and complexity.

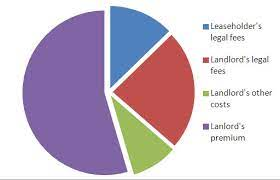

- Freeholder’s Costs: Typically, the leaseholder is required to pay the reasonable legal and valuation costs of the freeholder. This is in addition to their own costs.

- Land Registry Fee: This fee is for registering the new lease. It usually depends on the price you pay for the extension but generally ranges from £40 to £500.

- Miscellaneous Costs: These can include things like bank transfer fees or additional costs for dealing with a mortgage lender.

Saving on Legal Fees:

While legal fees are a necessary part of reasonable cost of the lease extension process, there are some very cost less ways you can pay for lease extension, and potentially save:

- Negotiate: Some solicitors might be willing to work for a fixed fee rather than an hourly rate.

- Shop Around: Get quotes from multiple professionals.

- Be Prepared: By understanding the process and having all your documents in order, you can speed up the process and reduce the time solicitors spend on your case.

Why extend a lease?

- Extending a lease with less than 80 years remains can significantly increase the value of your property.

- If your lease is short, few mortgage lenders will be prepared to lend against it and so it will be hard to sell the property – your potential pool of buyers will be limited to just cash buyers.

- Property with a short lease will be hard to remortgage (should you need to).

- As the lease length goes down, the cost of extending the lease goes up.

- Below 80 years, it attracts marriage value – which means if you extend, the freeholder is entitled to 50% of value which the extension adds to the property.

Lease Extension Costs

Understanding the costs associated with lease extension is vital for leaseholders considering this option. While the expenses of informal lease extension can seem daunting, the long-term benefits of securing a longer lease and preserving the property’s value often outweigh the initial the costs involved. To manage lease extension costs effectively, it’s recommended to research and compare quotes on lease extension costs from different professionals, explore fixed-fee options, and ensure complete transparency regarding fees. By making informed decisions, leaseholders can navigate the informal lease extension process with confidence and secure a more stable property future.

What is the Leasehold Valuation Tribunal (LVT)?

The Leasehold Valuation Tribunal, now part of the First-tier Tribunal (Property Chamber), is a specialized legal body established to handle disputes that arise between leaseholders and landlords in leasehold properties. These disputes often revolve around matters related to lease extensions, service charges, maintenance issues, and other disagreements arising from leasehold arrangements.

Key Functions and Powers:

- Resolving Disputes: The primary role of the LVT is to provide an independent forum for resolving disputes without the need for formal court proceedings. It aims to offer a quicker and more cost-effective alternative for resolving leasehold-related conflicts.

- Determining Lease Extension Premiums: In cases where leaseholders and landlords cannot agree on the premium for a lease extension, the LVT has the authority to assess and determine a fair premium based on factors such as property value, remaining lease term, and market conditions.

- Service Charge Disputes: The LVT can hear cases where leaseholders challenge the reasonableness or validity of service charges imposed by the landlord. It can assess whether the charges are in line with the terms of the lease and whether the services provided justify the costs.

- Major Works and Maintenance: Disputes arising from major maintenance works, repairs, and improvements can also be addressed by the LVT. Leaseholders can seek clarification on whether the proposed works are necessary, reasonably priced, and carried out in compliance with the lease terms.

- Variation of Lease Terms: The LVT can consider applications for varying lease terms when both parties are unable to agree. This may include changes to ground rent, maintenance responsibilities, or other terms affecting the leasehold arrangement.

Benefits for Leaseholders:

- Accessibility: The LVT provides a user-friendly and accessible process for leaseholders, allowing them to represent themselves or be represented by legal professionals if desired.

- Cost-Effective: Engaging with the LVT is often more cost-effective than pursuing legal action through traditional courts. The LVT process generally involves lower fees and simpler procedures.

- Expertise: The LVT comprises experienced panel members, including legal experts and surveyors, who are well-versed in leasehold matters. Their expertise helps ensure fair decisions and outcomes.

- Quicker Resolution: The LVT is designed to provide timely resolutions, allowing parties to reach decisions and conclusions more rapidly compared to court proceedings.

What is Marriage Value?

Marriage value, also known as “marriage uplift,” is a crucial factor in lease extension negotiations for properties with leases that have less than 80 years remaining. It represents the increase in the property’s value that occurs when the existing cost of a lease itself is not extend your extend a lease that is extended. This value arises from the combination (“marriage”) of the extended lease term with the property, resulting in significant reduction in potential financial gains for the leaseholder.

Calculating Marriage Value:

Marriage value is calculated by assessing the difference between the property’s value with the new lease or the existing shorter lease and its value with the new lease or the proposed longer lease after extension extend my lease amount. The formula involves considering various factors, including the property’s market value, the remaining left on the lease term, and projected future property values.

What is ground rent?

If you own a leasehold home, most often a flat or apartment, the freeholder landlord (or landlord) owns the land on which your lease or property sits and the landlord may charge you ground rent or additional fee for the use of this land.

Ground rent cost pay is different to service charges, which pay to cover reasonable costs of maintenance and repairs to the building and communal areas.

Understanding the Statutory Lease Extension Route:

The statutory lease extension route is a legal framework designed to empower leaseholders to extend their leases by an additional 90 years, while also reducing the ground rent to a peppercorn ground rent (a nominal amount ground rent). This the lease extension route grants leaseholders the right to extend their lease term and safeguards their interests.

Urban Development Act

The Leasehold Reform, Housing and Urban Development Act 1993 plays a pivotal role in shaping leasehold property ownership in the UK. By granting leaseholders the legal right to extend leases and purchase the freehold, the act empowers individuals to take greater control of their properties and investments. Understanding the key provisions, qualification criteria, and implications of this legislation is essential for leaseholders seeking to navigate the complex landscape of lease extensions and new leasehold enfranchisement practitioners.

Leasehold Reform Act:

The Leasehold Reform Act, encompassing various iterations over the years, constitutes a series of laws designed to address the unique challenges posed by leasehold property ownership. The act’s primary focus is to provide leaseholders with increased rights and options for extending leases, purchasing freeholds, and achieving a more equitable balance between leasehold interests and landlord obligations.

Legally Binding Contract:

A legally binding contract is a formal agreement between two or more parties that establishes rights, obligations, and remedies that are enforceable by law. Such contracts create a legal relationship between the parties involved, compelling them to fulfill their agreed-upon obligations and responsibilities.

Specialist Surveyor:

A specialist surveyor is a qualified professional with expertise in a specific area of property assessment or valuation. Their in-depth knowledge and training enable them to provide accurate and informed advice on various property-related matters, ensuring that property owners and stakeholders make well-informed decisions.

Conclusion:

Extending a lease is a significant decision that involves both financial and legal considerations. While the legal fees can add to the overall cost of a your extending your lease and extension costs a call, they are essential to ensure the process of extending your lease is done correctly, protecting your investment in the property. Before diving into a lease extension, it’s wise to budget for these and other costs, and, if possible, consult with professionals who can guide you through the intricacies of the process.

You can find more information on our website, Andrew Pridell Associates